Builders FirstSource: Are They Growing Too Fast?

Analyzing the Rapid Growth of Builders FirstSource: Is the Company Expanding Too Quickly?

Builders FirstSource's Earnings Beat Expectations: Is the Construction Boom Sustainable?

BLDR 0.00%↑ just released its earnings report for the quarter ending February 28th, 2023, and they exceeded market expectations by a long shot.So, what does this mean? Well, BFS reported a Normalized EPS (that's Earnings Per Share) of $3.21, which was $0.90 higher than the market estimate. And, they also reported a GAAP EPS of $2.79, which was $0.71 higher than the estimate. That's pretty impressive!But wait, there's more! BFS's revenue for the quarter was $4.36B, which is $104.26M higher than the market estimate. That's a big surprise, and a good one at that. What this all means is that BFS had a really great quarter. They managed to keep their costs under control, which led to higher profits. And, they were also able to generate more sales than expected, which is always a positive sign for revenue growth. Looking ahead, BFS is poised to continue on this growth trajectory. The construction industry is expected to remain strong, which means that BFS will likely benefit from this trend. And, with their strong market position and range of services, they're in a good position to take advantage of this growth. So, to sum it up, BFS had a really great quarter, and they're in a good position to continue growing in the future.

Builders FirstSource: A Comprehensive Provider of Building Materials and Services for the Construction Industry

Builders FirstSource is a US-based company that provides building materials, construction services, and manufactured components to professional homebuilders, sub-contractors, remodelers, and consumers. They offer a variety of products like lumber, plywood, and oriented strand board, along with specialty products such as wood floor trusses, wall panels, steel roof trusses, and engineered wood products. The company also provides turn-key framing, shell construction, design assistance, and professional installation services, as well as software solutions to retailers, distributors, manufacturers, and homebuilders. Builders FirstSource is a major player in the construction industry, providing a wide range of high-quality products and services to customers across the US.

Builders FirstSource: Key Growth Drivers Fueling Stock Price Momentum

Builders FirstSource's stock is driven by a few key factors. Firstly, the overall trends in the construction industry have a big impact on the company's revenue and profitability. If the construction market is booming, BFS can expect higher demand for its products and services, which can drive increased sales and earnings.

Secondly, building strong relationships with customers is critical to BFS's success. The company serves a wide range of customers, including professional homebuilders, sub-contractors, remodelers, and consumers. By maintaining strong relationships with these customers, BFS can ensure a steady stream of business and drive future growth.

Thirdly, product innovation is important for BFS to stay competitive in the market. The company has a history of introducing new products and services to meet the changing needs of its customers. By continuing to invest in product innovation and development, BFS can maintain a competitive edge and drive growth.

And finally, effective cost management is crucial to maintaining profitability and driving future growth. As a manufacturer and supplier of building materials, BFS is exposed to fluctuations in the cost of raw materials and other inputs. By managing its costs effectively, BFS can maintain its profitability and reinvest in the business to drive long-term growth.

Overall, these factors have a big impact on BFS's stock price.

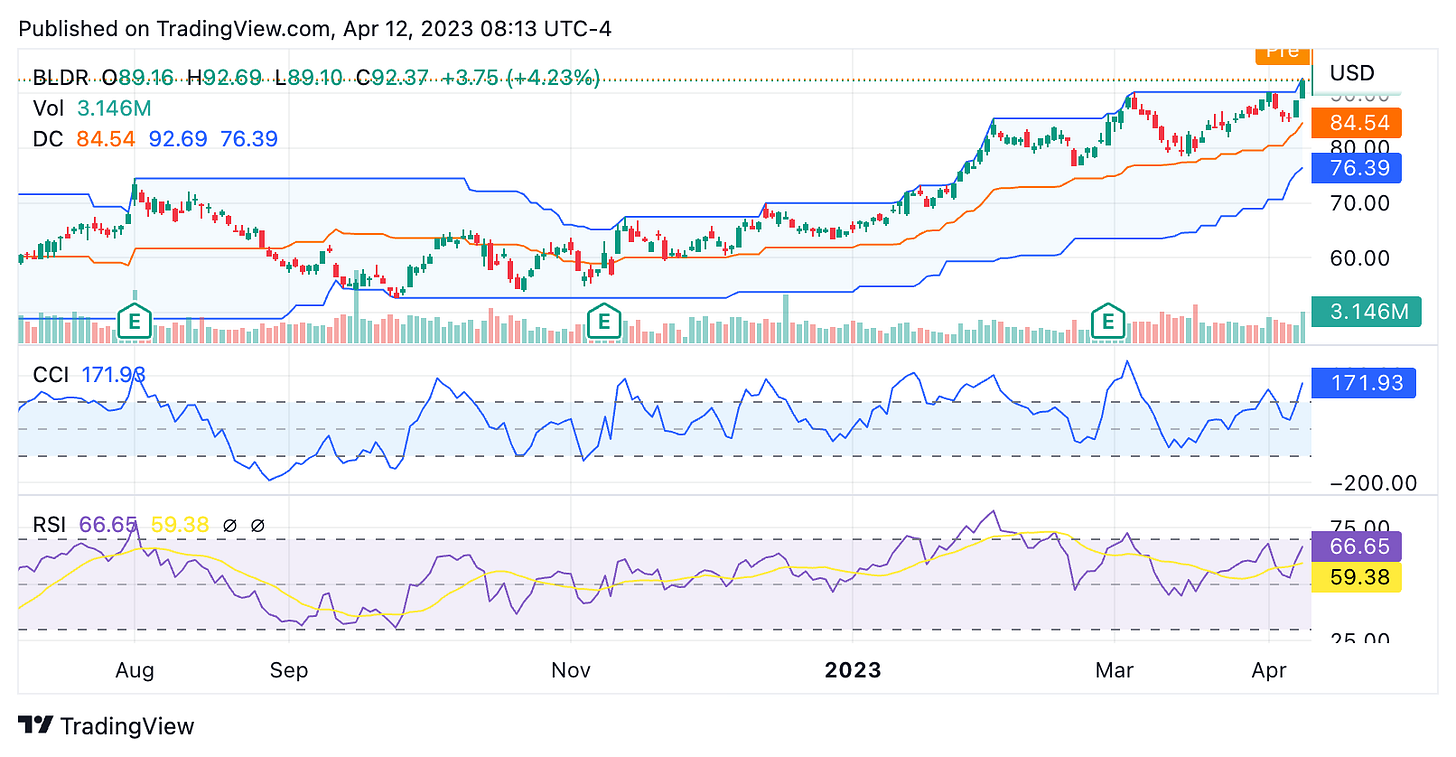

Analyzing the Growth Trajectory of the Stock ($BLDR) : A Comprehensive Chart Overview

The stock $BLDR has broken out and come in overbought zone still remaining an attractive buy as it has been trading at the upper end of its Don chain Channel (50) at an RSI over 70. The company's ability to maintain growth trajectory, disciplined cost management and improved guidance on its core revenue model indicates stock is poised to go up further and indicate a buy signal for the trendmyfriend investors. This can be observed from its price action performance as well in chart below when we see its superior performance from all its peers MAS 0.00%↑ , CSL 0.00%↑ ,$AOS , ALLE 0.00%↑ , OC 0.00%↑ .

Valuation : Analyzing $BLDR stock's Financial & Growth Potential

As seen above , we can clearly see $BLDR is undervalued despite being overbought and the risk-reward is still favorable for the stock as it trades at $92 now. On a base case scenario $BLDR stock trades at EV/EBITD of 3.5x which leads to the stock’s intrinsic value at around $120. This makes our actionable trade idea pretty clear on the stock . Click here to learn more on the actionable trade idea and subscribe to our Finance Newsletter and Premium Trade Ideas Plan.